Dear friends:

In our previous bulletin, we informed you that on July 24th., 2020, the Secretary of Finance and Public Credit (“Hacienda”) published in the Federal Official Gazette, the first amendment to the Foreign Trade General Rules of 2020.

In such amendment, among others, most of the benefits for the VAT (and IEPS) certified companies were eliminated. The only major benefit that Hacienda leaves to VAT-certified companies is the VAT credit upon the importation of goods, that is, in practice, not pay the 16% VAT applicable to all temporary imports.

Also, the amendment included that the VAT Certification was subject to payment of governmental fees of MXN$29,748.00 (USD$1,383.63 at an Exchange rate of USD$1.00 per MXN$21.50) to obtain the certification and its renewals.

Background.

The governmental fee was payable since 2003 for the OEA certification companies formally know just as “certified companies”.

Under the Federal Law of Fees (Ley Federal de Derechos), the Federal Government has charge, since 2003, a registration/renewal fee for the registration of certified companies (“Por la inscripción en el registro de empresas certificadas”). Since that year, when the Federal Law of Fees was amended to include this provision, it referred to companies certified under article 100-A of the Customs Law (now known as “OEA”).

Hacienda’s New Criteria.

On August 5, 2020, Hacienda issued a note stating that the VAT certified companies were required to pay the government fee since 2015 because the VAT certification is deemed to be a “registration of certified companies” and to avoid any adverse action or the imposition of penalties, VAT certified companies should pay such fees since 2015.

Hacienda’s criteria (in Spanish) may be found at: http://omawww.sat.gob.mx/pdec/Paginas/documentos/Pago_de_derechos_por_el_registro_de_empresas_certificadas.pdf

Fees since 2015.

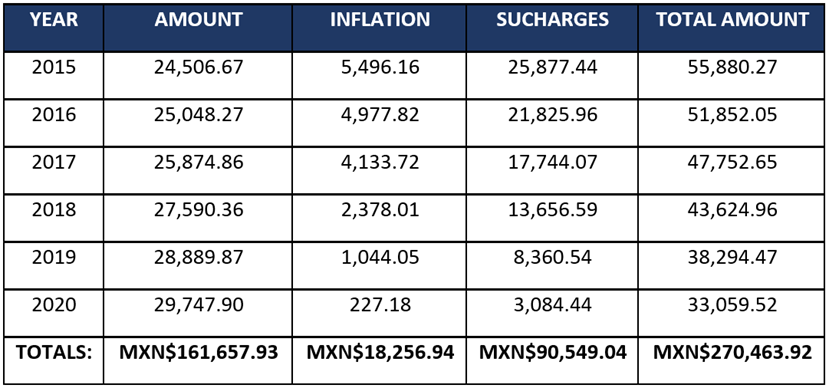

Assuming that your company secured its authorization in 2014 to begin as a certified company on January 1, 2015, and such certification has been renewed on a yearly basis, your company, according to Hacienda, owes MXN$270,463.92 or USD$12,579.71 (at an exchange rate of MXN$21.50 per USD$1.00) for the past five years.

This amount is updated on a monthly basis (the following amounts were calculated considering the consumer’s price index of June 2020):

(All amounts in Mexican Pesos)

Our Recommendation.

- We are recommending our clients to pay the government fees from 2015 to 2020.

- Our recommendation is a practical one. We believe that if VAT certified companies do not pay the governmental fees, Hacienda could take many actions, among others, suspending or revoking the current VAT certification and/or delay future ones or simply deny it.

- Once paid, VAT Certified companies could request a refund of such fees arguing that the VAT certification does not fall within the registration of certified companies and that the Law of Federal Fees was not intended to cover the VAT certification process.

- Any legal action to recover the paid fees would take approximately from 2 to 3 years. If successful, the amount paid would be refunded, updated for inflation purposes, and interest.

For any questions or comments, please do not hesitate to contact us.

Alejandro Pedrín | apedrin@tplegal.net

Héctor Torres-López | htorres@tplegal.net

Leobardo Tenorio-Malof | ltenorio@tplegal.net

Mauricio Tortolero | mtortolero@tplegal.net

Daniel Gancz-Kahan | dgancz@tplegal.net

Alejandro Ceballos | aceballos@tplegal.net

Elio Sánchez | ecsanchez@tplegal.net

Iván Curiel-Villaseñor | icuriel@tplegal.net

Raúl Escamilla-Sanromán | rescamilla@tplegal.net